Finance & Taxes, Personal Rep

Taking on the role of estate executor or personal representative can be overwhelming. Executors are responsible for navigating the probate process, identifying and managing assets, paying outstanding debts, and ensuring that all legal and financial obligations are...

Family & Heirs, Personal Rep

When navigating estate administration responsibilities while grieving, it’s crucial to avoid certain behaviors that can exacerbate your emotional and practical challenges. Don’t Rush or Make Major Decisions Hastily Grief can cloud judgment, leading to decisions that...

Estate Property, Personal Rep

Some people hold significant assets in online accounts, digital currencies, and virtual properties. Managing digital assets has become an essential aspect of estate planning and administration. Wide Range of Assets Executors, the individuals responsible for carrying...

Finance & Taxes, Personal Rep

Taxes are a critical aspect of estate administration that executors must address with priority. In California, tax obligations precede many other financial duties, including debts to private creditors and even distributions to beneficiaries, as outlined in estate...

Estate Property, Personal Rep

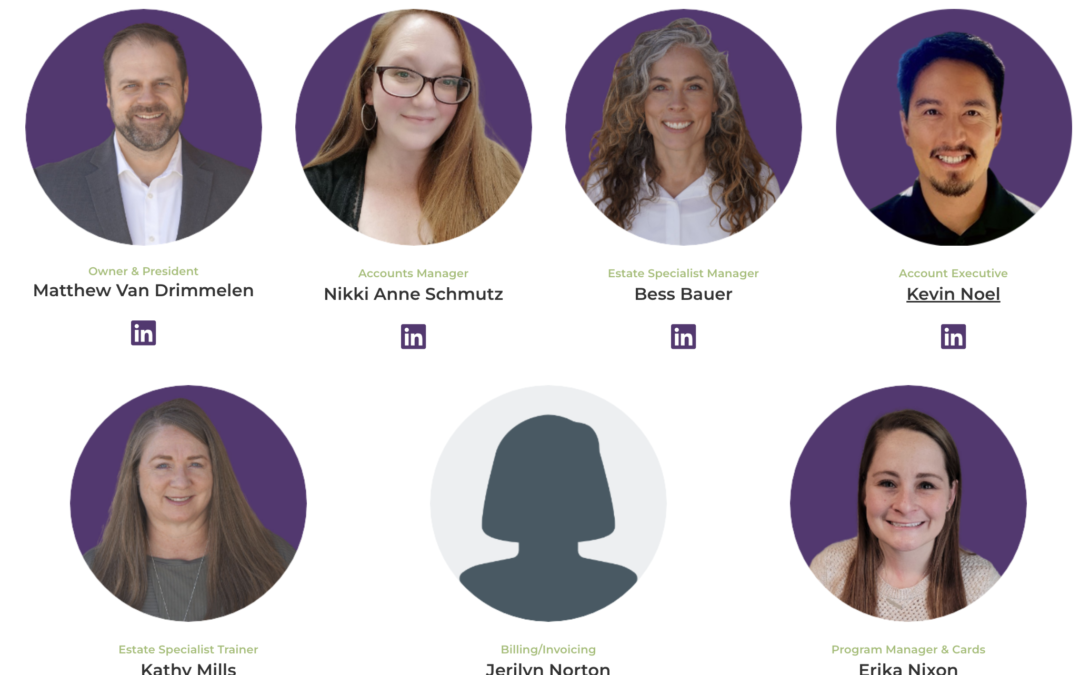

Losing a loved one is an incredibly difficult experience, compounded by the daunting task of handling their final affairs. During this emotional time, the responsibility of managing probate and estate matters can be overwhelming. Fortunately, specialized services are...