In California, the probate process is a legal procedure for settling a deceased person’s estate. The court oversees the distribution of assets to ensure that debts are paid and the remaining assets are distributed according to the decedent’s will or state law if there is no will.

Who Can File for Probate:

Any Interested Party: This can include heirs, beneficiaries, creditors, or any individual with a legitimate interest in the estate.

Executor Named in the Will: If the deceased left a will, the person named as the executor in the will typically files for probate.

Next of Kin: If there is no will, a close family member, such as a spouse, child, or parent, often files for probate.

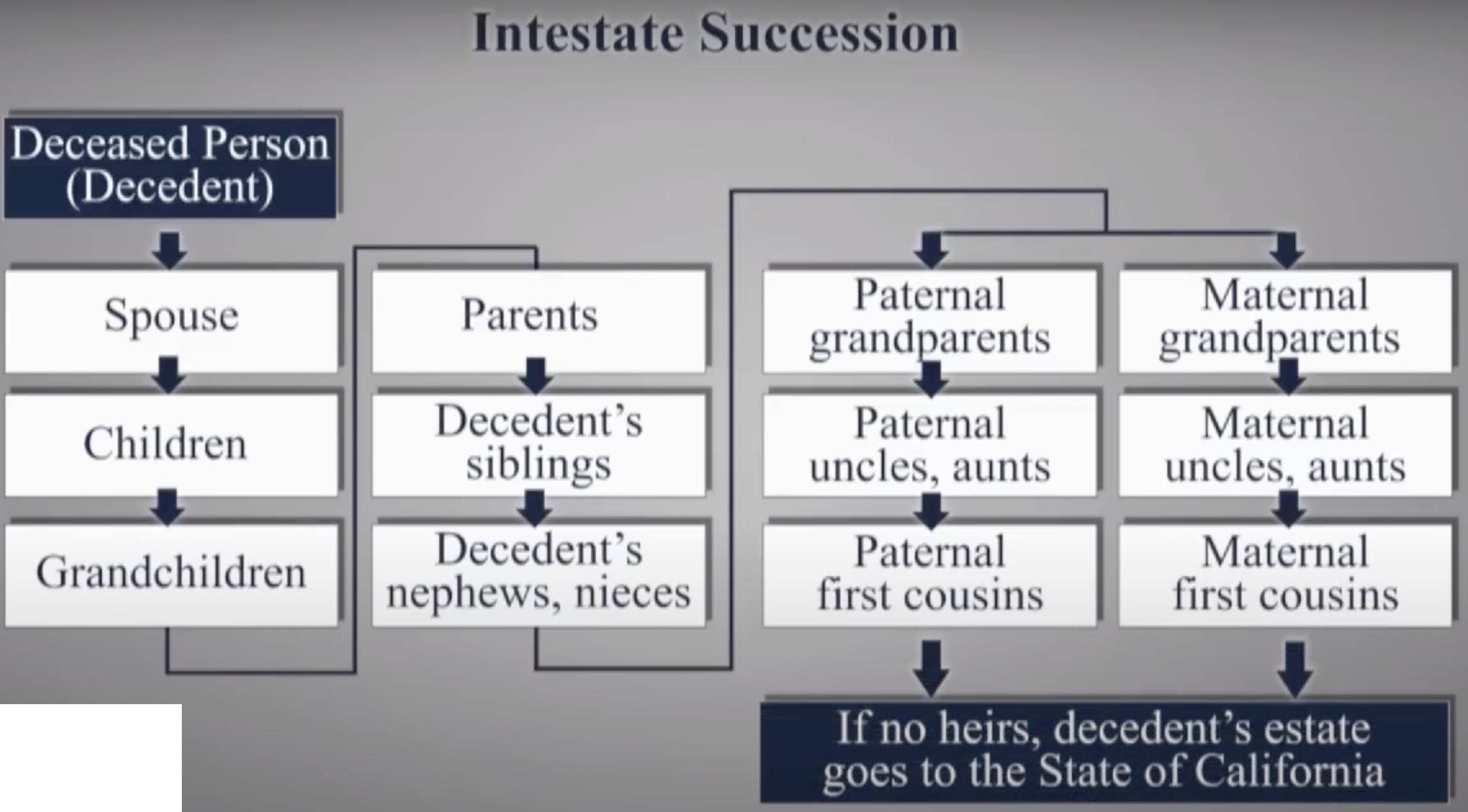

Priority in Appointing a Personal Representative:

If there is no will or the named executor cannot serve, California law establishes a priority order for who may be appointed as the personal representative (administrator) of the estate.

This order is typically as follows:

1. Surviving spouse or domestic partner.

2. Children.

3. Grandchildren.

4. Other descendants.

5. Parents.

6. Siblings.

7. Issue of siblings (nieces and nephews).

8. Grandparents.

9. Issue of grandparents (aunts, uncles, and cousins).

10. Other next of kin.

Key Points to Remember:

Priority is Determined by Relationship: The closer the familial relationship to the deceased, the higher the priority to act as the estate’s Personal Representative.

Court’s Discretion: The court can appoint the best-suited person if disputes arise or there is no clear priority.

Contesting the Appointment: Heirs or interested parties can contest the appointment of the personal representative if they believe the person is unsuitable.

The probate process involves notifying all interested parties, inventorying the estate’s assets, paying debts and taxes, and distributing the remaining assets according to the will or state law.